Building an addition onto your home provides you with more space, whether you need it for a living area or for storage. You can build additions onto the side or back of your home, or build up rather than out. No matter what kind of addition you’re thinking of building, it’s important to think about how to finance it. Home additions are costly projects, so you’ll want to make sure you find the right financing to fit your budget. Keep the following options in mind for home improvement loans for your home addition.

Home Equity Line of Credit

A home equity line of credit (HELOC) gives you a chance to put your home’s equity to use. Equity builds up as you pay off your mortgage, so the amount available will vary. You can estimate how much you’ll get from a HELOC by subtracting what you still owe on your mortgage from your home’s property value. HELOCs have limits on the amount you can take out, so keep this in mind when determining your budget. The longer you’ve owned your home, the higher your HELOC should be.

RenoFi Loans

These loans act as a second mortgage on your house. They factor in the value of your home after you’ve completed your home addition project. This allows you to borrow a higher amount compared to other financing options. With a RenoFi loan, you’ll typically get a low fixed interest rate and repayment terms of up to 20 years.

Cash-Out Refinance

When you do a cash-out refinance to cover the cost of a home addition, this involves borrowing a higher amount than you owe on your current mortgage. You would then apply this amount to your home addition project. A cash-out refinance requires you to have equity, so the amount you’ll be eligible for can vary.

Construction Loans

Home construction loans are another option for financing a home addition. These loans typically have higher interest rates and shorter terms for paying it off, which you should keep in mind when weighing your options. You could end up with a longer-term mortgage once your home addition is done if you use a construction loan.

About the Author

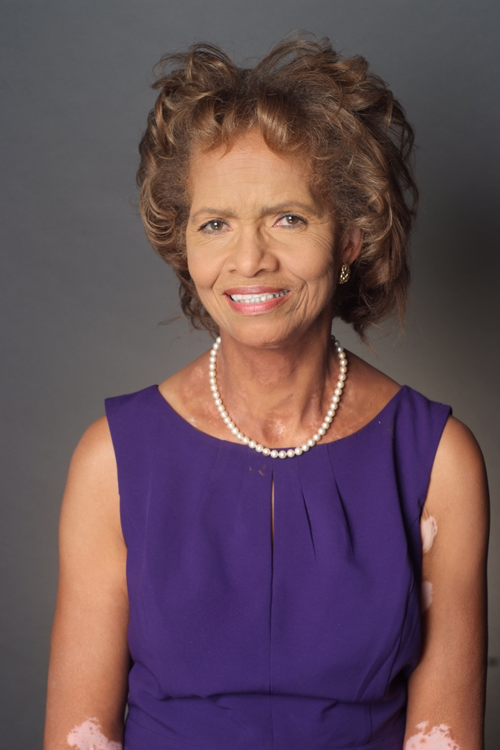

Sandy Malbrue

Hi, I'm Sandy Malbrue and I'd love to assist you. Whether you're in the research phase at the beginning of your real estate search for representation or you know exactly what you're looking for, you'll benefit from having a real estate professional by your side. I'd be honored to put my 21 years real estate experience to work for you. Be it to gain wide exposure for your home with my marketing plan, negotiate offers or manage the transaction once you've accepted an offer, in a way that will get you the best price and cause the least amount of disruption to you life as possible.

If you are a buyer, allow me put those skills to work for you to help with the pre-approval process, work with you to locate and arrange for you to view homes of interest to you , and negotiate your offer. Once you have an accepted offer, I will help you arrange inspections, I will manage the transaction for you, from helping to arrange for inspections to keeping you up to date on contingency removals and walking you through the process to a new set of keys.

Let's do this!