If you're renting a nice house, condo, or apartment, there's a good chance your monthly rent check is almost as much as a mortgage payment. Perhaps you've realized this and have been asking yourself why you're contributing to someone else's nest egg, instead of your own! If that sounds familiar, you may be ready to take the plunge into home ownership.

If you're renting a nice house, condo, or apartment, there's a good chance your monthly rent check is almost as much as a mortgage payment. Perhaps you've realized this and have been asking yourself why you're contributing to someone else's nest egg, instead of your own! If that sounds familiar, you may be ready to take the plunge into home ownership.

The other half of the equation is whether you're financially ready, and that would depend on a variety of things, including your credit rating, your debt-to-income ratio, and your ability to make a sufficient down payment on a new home. Although a 20% down payment is a desirable target to aim for, there's often a lot of flexibility on how much you're required to put down on a house.

One of the main reasons a 20% down payment is desirable is that it takes you "off the hook" for having to pay monthly private mortgage insurance (PMI). The second advantage of making a substantial down payment is that it reduces the principal amount of your loan, which, in turn, lowers your monthly payments even more. However, if you're ready to become a home owner, but can't afford a 20% down payment, you can often eliminate PMI payments earlier than scheduled by making extra principal payments. The bank or mortgage company you decide to work with can fully explain their policies and what your options are.

If you are interested in making the transition from renter to home owner, now's a good time to start talking to loan officers. If nothing else, you'll be educating yourself on the intricacies of buying a home. Working with an experienced real estate agent is another way to learn the ropes, so to speak, when it comes to the home buying process.

Other than the financial benefits of building equity in your own home, there are also a lot of practical advantages. If you're currently a renter, for example -- especially in an apartment building, duplex, or townhouse -- you're probably tired of the lack of privacy and the unwelcome noises you can often hear through walls, floors, and ceilings.

Becoming a home owner brings with it a pride of ownership and the ability to plant trees, bushes, and gardens on your own property. Depending on what's available in your price range, you can also enjoy your own private deck, screened in porch, or patio. Options for the kids (if you have them) include swing sets, sand boxes, and room to play backyard sports or run through a water sprinkler during the hot weather.

If you feel like you are ready to take the plunge into home ownership, the first step is to make lists of your requirements, your preferences ("wish list"), and financial resources. The next step is to find a good real estate agent to start showing you homes that fulfill your needs and check off as many items on your wish list as possible!

About the Author

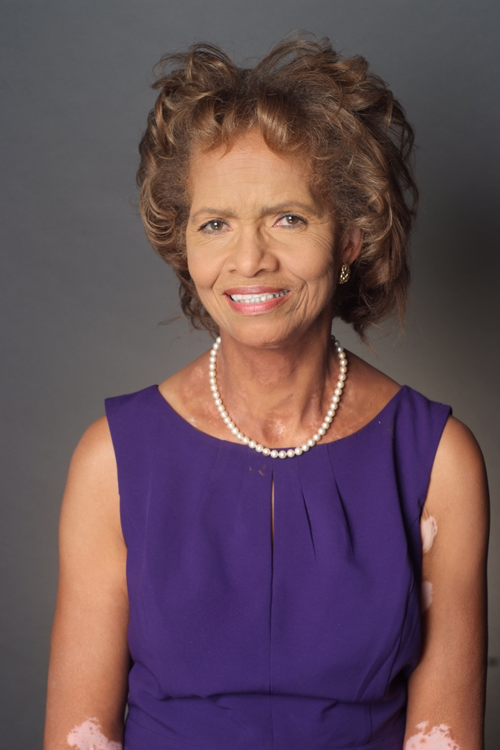

Sandy Malbrue

Hi, I'm Sandy Malbrue and I'd love to assist you. Whether you're in the research phase at the beginning of your real estate search for representation or you know exactly what you're looking for, you'll benefit from having a real estate professional by your side. I'd be honored to put my 21 years real estate experience to work for you. Be it to gain wide exposure for your home with my marketing plan, negotiate offers or manage the transaction once you've accepted an offer, in a way that will get you the best price and cause the least amount of disruption to you life as possible.

If you are a buyer, allow me put those skills to work for you to help with the pre-approval process, work with you to locate and arrange for you to view homes of interest to you , and negotiate your offer. Once you have an accepted offer, I will help you arrange inspections, I will manage the transaction for you, from helping to arrange for inspections to keeping you up to date on contingency removals and walking you through the process to a new set of keys.

Let's do this!