Photo by Vlada Karpovich from Pexels

While your credit score will play a role what your mortgage interest rate will be, there are also various types of loans that can increase or lower your monthly mortgage payment. In general, there are two specific loan types, adjustable rate loans, known as an ARM and fixed rate. However, within these two categories, there are various options you should be aware of before shopping for a mortgage.

Fixed Rate Loans

The fixed rate loan is exactly what it sounds like. This means your interest rate will remain stable throughout the life of your loan. Keep in mind, this does not mean your payment will remain the same — if your property taxes or insurance premiums increase and are part of your mortgage payment, the monthly payment will increase.

There are four categories of fixed rate loans that are available to borrowers. The shorter the term of the loan, the lower the interest rate. However, the shorter the term of the loan, the higher your monthly payment will be. The four categories are 10 years, 15 years, 20 years, and the most popular, the 30-year fixed rate mortgage.

Fixed rate mortgages can be as short as 10 years and as long as 30 years. Assuming you were able to secure a $100,000 30-year mortgage at a fixed rate of 3.92 percent, your total mortgage payments would be $172,000 over the life of the loan. If you were to secure a 20 year at a fixed rate of 3.5 percent, you would pay approximately $139,190 over the life of the loan. As you can see, a small decrease in rate, and decrease in time can make a significant difference.

Adjustable Rate Mortgages

If you are considering an adjustable rate mortgage, your lender may offer you different options. The most common types of ARMs are 3/1 ARMs, 7/1 ARMs and 10/1 ARMs. What this means is the first number (3, 7 and 10) means your rate will be fixed over that number of years. The second number (1) means your rate will change every year after the fixed rate period ends.

ARMs typically have what is known as a “cap” which means the amount your loan can increase cannot increase more than a specific amount. The caps may be defined as how much the monthly payment can increase over the life of your loan, over how much the rate can rise over the life of your loan, or how much the rate can increase from year to year. Before agreeing to accept an ARM, make sure you have a full understanding of the terms. It is also worth noting that many ARMs also have prepayment penalties associated with them. This means you may pay a fee to the lender if you sell your home, or you decide to refinance your mortgage.

Deciding whether a fixed rate or an adjustable rate mortgage is the right choice for you can be challenging. Some borrowers may opt for an adjustable rate, so they can meet other criteria such as debt to income ratios. Your real estate agent, and your mortgage lender can help you determine which loan is right for your needs based on the value of your home, how long you plan to own the home, and your current financial status.

About the Author

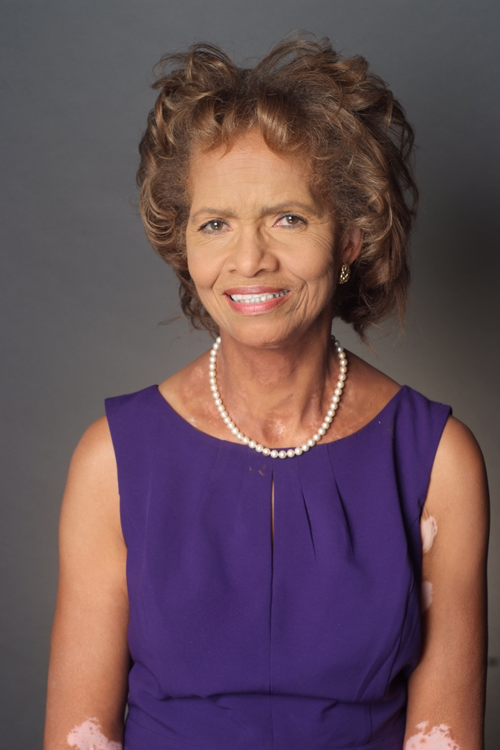

Sandy Malbrue

Hi, I'm Sandy Malbrue and I'd love to assist you. Whether you're in the research phase at the beginning of your real estate search for representation or you know exactly what you're looking for, you'll benefit from having a real estate professional by your side. I'd be honored to put my 21 years real estate experience to work for you. Be it to gain wide exposure for your home with my marketing plan, negotiate offers or manage the transaction once you've accepted an offer, in a way that will get you the best price and cause the least amount of disruption to you life as possible.

If you are a buyer, allow me put those skills to work for you to help with the pre-approval process, work with you to locate and arrange for you to view homes of interest to you , and negotiate your offer. Once you have an accepted offer, I will help you arrange inspections, I will manage the transaction for you, from helping to arrange for inspections to keeping you up to date on contingency removals and walking you through the process to a new set of keys.

Let's do this!